Under the Andrews-Allan Labor Government, Victoria already has the highest property taxes in the nation, with 44 per cent of a new house and land package in greenfield development areas in Melbourne made up of government taxes, fees and charges according to the Urban Development Institute of Australia.

Despite this, reports this week revealed Labor plans to introduce a new “value-capture framework” that would enable further property-based taxes across at least ten Melbourne suburbs, including Camberwell, Preston, Chadstone, Epping, Moorabbin, Ringwood, Broadmeadows, Frankston, Essendon North and Niddrie.

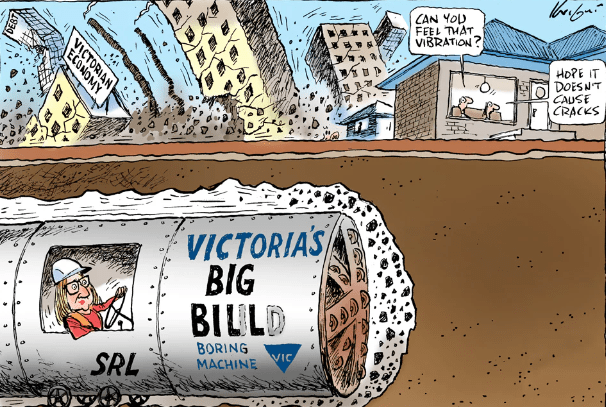

Following a decade of financial mismanagement, Labor’s debt is set to reach a record $187.8 billion by 2027-28, with interest repayments expect to exceed $1 million per hour.

Shadow Treasurer, Brad Rowswell, said: “Labor’s property taxes aren’t about fixing the housing crisis, but a desperate attempt to fill their budget black hole.

“Higher property taxes will mean fewer homes, higher prices and poorer housing choices. Labor cannot manage money and Victorian homebuyers are paying the price.”

“After a decade in office, Labor’s ever-increasing property taxes have pushed Victoria’s housing sector to the brink.

“Labor’s latest property tax will only worsen the housing crisis, undermine confidence in the residential construction industry and push dreams of homeownership further out of reach for Victorians.”

Following 12 interest rate hilkes, record migration and with stamp duty on an average home in Metro Melbourne ranging between $40,000 – $60,000 this isn’t the time for new taxes.

Leave a comment