Experts suggest housing is 40% overvalued, making it one of the world’s priciest assets.

There’s lots of news about housing prices, clearance rates, ‘hot’ suburbs, interest rates, and where to get the best loan. There’s much less about property values, or valuation.

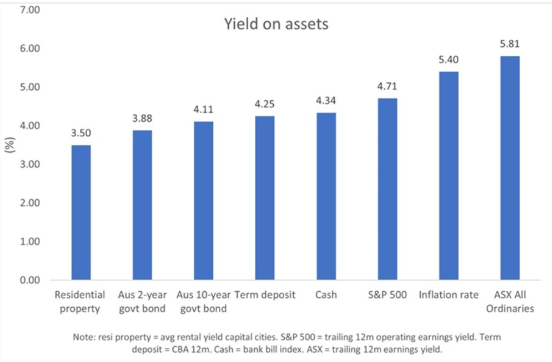

I’m going to suggest that valuations do matter and they’re little mentioned because housing remains ludicrously priced. I’ll also argue there are very high odds that returns from the ASX will handily beat those from residential property over the next 10 and 20 years.

How do you value a property? Commercial property valuers will tell you that valuations are based on the discounted cashflows, capitalization rates or price-to-book values from recent transactions.

In residential property, it gets murkier. Valuations aren’t based on land value. They’re not based on cashflows. They’re not based on book values. In my experience, they’re largely based on recent transactions in the neighborhood.

The problem with this is that current prices or recent transactions tell you nothing about the value of a property. It’ like saying that the current price for the stock market equates to fair value of the market – because prices equal fair value. It’s a circular argument that doesn’t make sense.

Average 3.5% yield on residential property is well below the 10-year Government bond. It’s also below what you can get from cash and a term deposit. And it’s way lower than the current inflation rate.

It doesn’t tell the full story though. The yield on residential property is based on a gross yield before taxes and costs.

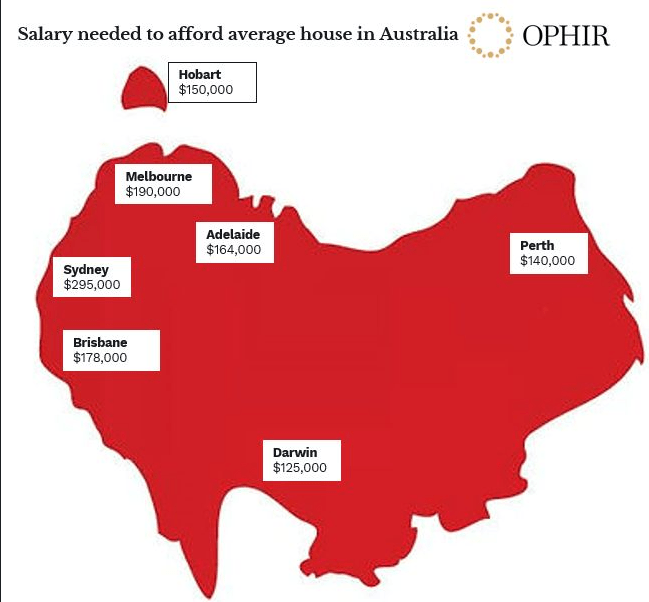

The 2023 Demographia Affordability Survey says the median multiple of house prices to income for major cities is 8.2x in Australia versus 5x for the US and UK. In Sydney, it’s more than 13x. And the time it takes for someone on a full-time wage to save for a 20% housing deposit has doubled from 5 to 10 years since the 1990s.

Leave a comment